Feb.28, 2021

Here is the article.

Highlights:

- Aside from the Jan. 27 short-squeeze from Reddit users that lifted NOK stock to a $9.79 high, the company has no catalysts ahead.

- Nokia has 5.61 billion shares outstanding. It could increase its earnings per share by buying back stock. Shares may fall to the $2.34-$3.00 range in the coming months as frustrated investors sell. That gives Nokia a chance to lower the share float at lower costs.

Nokia (NYSE:NOK) is getting left out of the market’s incredibly strong performance. Aside from the Jan. 27 short-squeeze from Reddit users that lifted NOK stock to a $9.79 high, the company has no catalysts ahead.

Nokia’s prospects in the telecom space are not entirely lost. Demand for high-performance networking gear is increasing. Mobile device usage is soaring and internet traffic volumes continue to rise. Nokia management must restructure its business to report higher profit margins.

NOK Stock Fades

Nokia posted good gross margins and revenue in its fourth quarter. The stock failed to get a lift from the report. Strong buying volumes the month before at higher prices will leave a mark on its stock.

Retail investors who overpaid for the stock will look for any opportunity to sell the stock, while long-term investors who missed the chance to sell the stock at between $7 and almost $10 will get frustrated.

Unless it gets a buyout offer, Nokia will lag while the market soars to new highs. Cisco Systems (NASDAQ:CSCO) might offer to buy Nokia for its intellectual property (IP) and 5G positioning. Yet Cisco has its problems.

Cisco failed to capitalize on the telework boom due to the pandemic as Zoom Video (NASDAQ:ZM) ate its lunch. If it had the foresight to develop WebEx for video meetings, its growth would not have stalled.

Patent Revenue

Nokia’s IP is still a cash cow that will give gross margins a lift. Management does not tout its value because of the uneven IP payment schedule.

More recently, BlackBerry (NYSE:BB) reportedly settled a long-lasting legal battle with Facebook (NASDAQ:FB) on the former’s patents. The settlement suggests that companies are now willing to set aside disagreements. Last October, Lenovo (OTCMKTS:LNVGY) lost its case against Nokia. A Regional Court in Munich, Germany, ordered a sales ban on Lenovo’s laptop because Lenovo infringed on Nokia’s video coding patent.

Cases like that imply that Nokia may amass a growing stream of patent revenue. It needs a growing cash flow to invest in the business. Plus, buying back shares, reinstating the dividend, and increasing research and development activities are critical steps in increasing shareholder value.

A growing worldwide ban against China-based Huawei is a one-time opportunity for Nokia. Growing competition in 5G and other wireless technology will encourage a country to protect its domestic companies. As long as the momentum for countries to ban Huawei remains strong, Nokia will have a chance to grow its wireless base station market.

Outlook

Without the Huawei tailwind, Nokia forecasts a strong full-year 2021. Net sales will be between 20.6 billion euro and 21.8 billion euro. The company ended the fourth quarter with a strong liquidity position of 8.1 billion euro in cash and investments. It has no major debt due until 2024 and beyond. The healthy financial positioning suggests that Nokia may take advantage of its low stock price.

Nokia has 5.61 billion shares outstanding. It could increase its earnings per share by buying back stock. Shares may fall to the $2.34-$3.00 range in the coming months as frustrated investors sell. That gives Nokia a chance to lower the share float at lower costs.

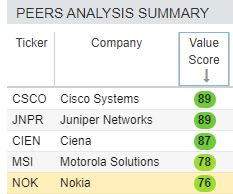

As you can see in the chart to the right, Nokia scores fairly well on value.

Nokia’s Capital Markets Day is on March 18. It will assess its dividend policy and update its investors by then. With a short float of only 1.01%, Nokia has no incentive to reinstate its dividend. Investors are not buying the stock for the income potential. They are betting on the growing 5G network upgrade demand lifting revenue.

At a forward price-earnings ratio of around 18 times, Nokia stock is cheap. Investors are better off holding the stock now instead of chasing expensive speculations.

A buyout, a dividend reinstatement, or a surprisingly strong quarter would quickly put an end to the stock’s weak performance.