Exxon faces $48B shortfall through 2021 - Reuters

Sep. 08, 2020 12:12 PM ETExxon Mobil Corporation (XOM)Exxon Mobil Corporation (XOM)By: Kim Khan, SA News Editor138 Comments

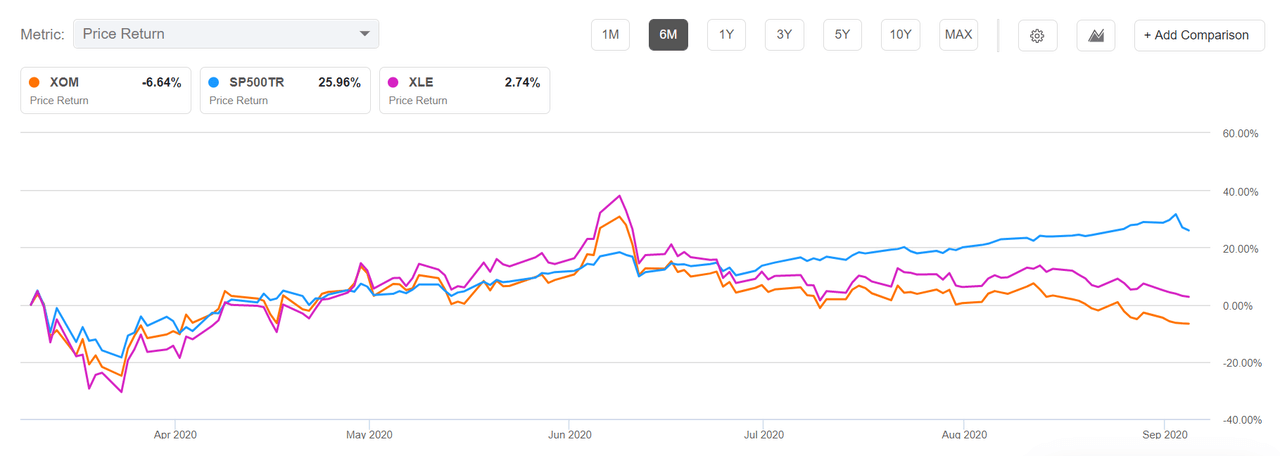

- Exxon Mobil (XOM, -3%) is staring at a huge cash crunch as bets on rising demand sour, which will force the company to cut jobs and may put its dividend in jeopardy, according to a study by Reuters.

- With global demand for oil hit hard, Exxon's plans for aggressive expansion and to become a top player in shale and LNG are in question.

- The company is looking at a shortfall of $48B through the end of next year, according to a Reuters analysis using cash from operations, commitments to shareholder payouts and costs for the expansion program.

- About 10% of its workforce will face "harsh reviews" and Exxon is looking at cutting its enviable retirement benefits.

- There could also be pressure to cut Exxon's dividend, although CEO Darren Woods said in July it was sacrosanct. Exxon's current annual payout is $3.48, with a yield of 8.9%.

- The stock is down 44% year to date. It was booted out of the Dow Jones Industrial Average last month after 92 years in the blue-chip index.

- Take a deeper look at Exxon's quarterly cash flow.

No comments:

Post a Comment