Feb. 19, 2022

I like to read more on PSFE stock and learn better about business.

While Paysafe plays an important role in facilitating payments in the digital world, shares of Paysafe have been on a wild ride in 2021, in large part because the company's revenue growth has disappointed. Paysafe's revenue growth stagnated over the last year which is a problem in an industry that has been spoiled for growth. In the most recent earnings card from November, Paysafe disclosed revenues for the third quarter of $353.6M compared to $355.5M in the year-earlier quarter, meaning the firm's revenue base dropped half a percentage point. Revenues for the period January to September were $1.12B but also only increased a disappointing 5.6% year over year. Paysafe's Q3'21 revenues were below guidance, adding to the pressure and driving investors out of the stock.

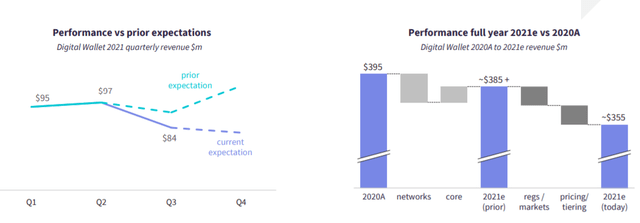

At the same time, the firm's losses widened due to miscalculations in the digital wallet business. New gaming regulations negatively impacted sports betting activity in Europe and the return to a normal, work-centered life after the COVID-19 pandemic hurt the segment's results. Revenue expectations for the digital wallet segment were materially adjusted downward for FY 2021 and Paysafe now expects a 10% year over year drop to $355M in segment revenues for the last fiscal year.

Paysafe

No comments:

Post a Comment