Here is the article.

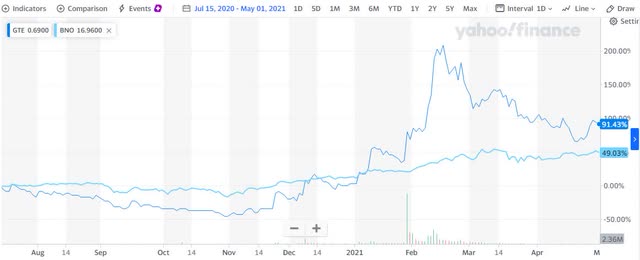

The last year was a roller coaster ride for Gran Tierra Energy (GTE) shareholders. The intermediate oil producer has been buffeted by highly volatile crude oil prices, the COVID-19 pandemic, rising political volatility in Colombia and heightened security risk. Since my July 2020 article, where the possibility of Gran Tierra being priced for bankruptcy was explored, the beaten down intermediate oil producer has gained an impressive 91% compared to the U.S. Brent Oil Fund (BNO) rising 49%.

Source: Yahoo Finance

Risk for Gran Tierra appears to be ratcheting up despite an improved outlook for oil prices. There are a series of threats to Colombia’s oil industry which could impact Gran Tierra’s operations. These include a third viral wave which is exacerbating many of Colombia’s structural economic, social and governmental failings. New round national strikes are occurring in protest of President Duque’s tax reform, rising violence and failure to implement the FARC peace deal. Lawlessness and violence are rising in rural regions, notably in those areas where oilfields are located. Those events along with an ongoing security crisis, renewed pandemic lockdowns in major cities and heightened political volatility are threatening oil industry operations. Despite those issues in my last article on Gran Tierra, I found that the company was undervalued and there are signs that remains the case despite considerable risks abounding.

Latest developments

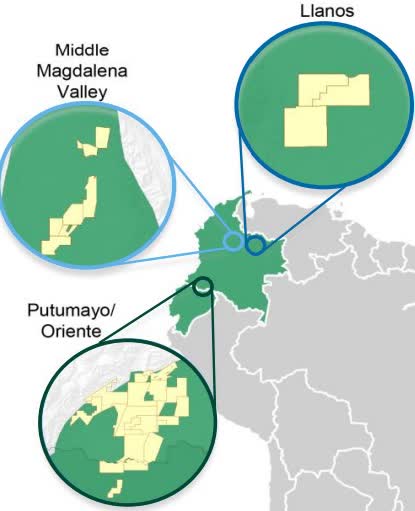

Gran Tierra is focused on diversifying its operations having acquired oil acreage in Colombia’s Llanos, Middle Magdalena Valley and Putumayo Basins. That focus on diversification helps to reduce much of the risk initially associated with the driller’s earlier focus on the Putumayo Basin.

Source: Gran Tierra Corporate Presentation April 2021

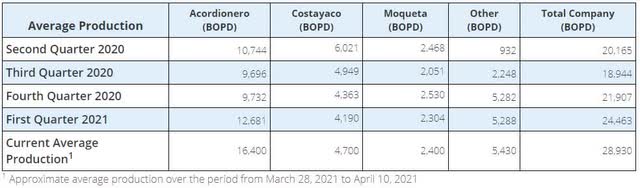

During the second week of April 2021, Gran Tierra released an operational update indicating that its operations as well as outlook are improving. First quarter 2021 production of 24,463 barrels per day was 12% greater quarter over quarter, although it was still 17% lower than for the same period in 2020, indicating that a return to pre-pandemic production levels is a long way off. That coupled with the impressive oil price rally since the start of January 2021, which sees Brent up by 35% for the year to date, will give earnings a solid boost, especially when it is considered that Gran Tierra is now pumping 28,930 barrels daily.

Source: Gran Tierra 12 April 2021 Operational Update

The notable increase in crude oil production can be attributed to the Acordionero field in the Middle Magdalena Valley Basin where Gran Tierra has invested heavily in developing operations and addressing operational failings. Acordionero's first quarter 2021 oil production expanded by an impressive 30% compared to the previous quarter to be 12,681 barrels daily, its highest level for four quarters. In contrast production at Gran Tierra’s second and third largest oilfields, Costayaco and Moqueta, declined by 4% and 9% quarter over quarter respectively. That decline is being addressed by Gran Tierra through a well workover campaign, with six Costayaco wells completed during the first quarter 2021, which will lift production at those fields. As a result of the marked improvement in production volumes, the driller reaffirmed its 2021 production guidance of an average of 28,000 to 30,000 barrels per day.

While the outlook for crude oil prices no longer poses a distinct threat to Gran Tierra with Brent rallying by over 35% since the start of 2021 to be trading at around $66 per barrel which is significantly higher than the $49 base case budget, headwinds abound. A key issue is a growing security crisis in Colombia which has seen a sharp uptick in violence, lawlessness and attacks on energy sector infrastructure. Colombian think tank Indepaz (Spanish) announced there were 33 massacres in Colombia during the first four months of 2021, seven higher than the same period in 2020 and only three less than for the full year 2019, which had the highest number since 2014. The rising number of social leaders and community activists being killed is a significant problem with 57 murdered for the first four months of 2021. In 2019, when violence was at far lower levels than 2020 or 2021 the UN High Commissioner for Human Rights described it as (Spanish) “an endemic level of violence”. This has all occurred during Duque’s term as president.

That uptick in violence and lawlessness is sparking considerable civil unrest and dissent toward Duque’s administration. That has already translated into oilfield invasions in the Llanos Basin and will likely trigger more community blockades of major transport arteries, such as the Pan American highway, impacting oil industry operations. Community blockades in 2019 and 2020 impacted Gran Tierra’s operations in the Putumayo Basin taking around 4,000 barrels per day offline. Pipeline sabotage and outages are a chronic problem in Colombia, where they are the only cost-effective means of transporting crude oil across the Andean country’s rugged terrain. According to Colombia’s national oil company Ecopetrol crude oil theft during 2020 rose 46% compared to a year earlier and the number of illegal valves on pipeline is growing. The theft of petroleum as well as derivative products is being exacerbated by the pandemic, a sharp uptick in poverty and growing lawlessness because of an increasingly weak state.

Another risk to Gran Tierra’s operations and bottom-line is Duque’s planned tax reform. The national government in Bogota is desperately attempting to raise additional revenue equal to 1.4% of GDP by 2024, or around $4 billion, in response to the forecast 2021 budget deficit blowing out to over 9% of GDP. The move has been described by ratings agency Fitch as being necessary to stabilize public finances and debt. The tax reform will likely see the removal of various incentives and tax breaks for Colombia’s oil industry as well as higher corporate taxes in a system which ratings agency Fitch described as “more burdensome for business than other Latin American countries.” This will act as a tremendous disincentive to attracting foreign investment in Colombia’s petroleum industry in a country which is already is battling to attract the investment required to boost economically crucial crude oil reserves and production. It will likely eventually impact Gran Tierra’s bottom-line, at a time when the intermediate oil producer has a lot to prove to investors. The proposed tax reform is fomenting further violence and civil unrest in a country where people are suffering financially because of the pandemic. That growing opposition will likely lead to further community blockades of key industries and transport infrastructure, potentially impact Gran Tierra’s operations.

A sharp spike in coronavirus cases in Colombia and emergence of a third wave have forced the government to reinstate lockdowns in major cities, including the capital Bogota, the second largest city Medellin and the country’s principal port Barranquilla. If the health crisis worsens stricter measures could be enacted with the potential to impact oil industry operations in a similar manner to the five-month lockdown implemented in 2020.

Nevertheless, by ramping up production at the Acordionero field in the Middle Magdalena Valley Basin Gran Tierra has reduced its dependence on the Putumayo Basin, thereby reducing the potential fallout from the risks discussed and their impact on production.

Investment hypothesis

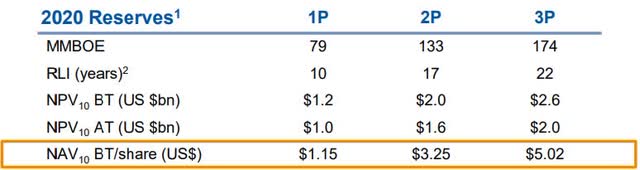

Gran Tierra’s focus on developing the Acordionero oilfield and its growing production are positive developments. There is every indication that despite rising political turmoil and geopolitical risk in Colombia that the company will meet 2021 production guidance. That coupled with Brent now trading at $66 per barrel of $17 per barrel higher than its base case 2021 budget and $10 a barrel greater than the high case means earnings have the potential to be higher than forecast by management. Higher oil prices also boost the net present value of Gran Tierra’s 1P, 2P and 3P oil reserves giving its net asset value a solid lift. Currently, Gran Tierra trades a deep discount to its net asset value per share as the table below demonstrates.

Source: Gran Tierra Corporate Presentation April 2021

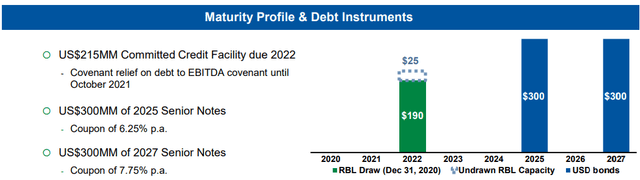

High debt, totaling $805 million, is a concern but Gran Tierra is actively addressing the issue and the risk is not as great as initially appears. Gran Tierra reduced the debt outstanding on its credit facility by $10 million to $180 million by the end of the first quarter 2021, while bolstering cash and equivalents to $20 million. The remaining $600 million of debt is well-laddered.

Source: Gran Tierra Corporate Presentation April 2021

Note: The credit facility was reduced to $180 million with a first quarter 2021 debt repayment of $10 million.

The first tranche of $300 million does not fall due until 2025 and the remaining $300 million in 2027, providing Gran Tierra with time to benefit from higher oil prices and raise the funds required to meet its financial obligations.

When the steady improvement to Gran Tierra’s balance sheet is considered along with the company trading at a 42% discount to its net asset value per share indicates that the company is heavily undervalued by the market. Not only does that number show there is considerable upside available but that there is a solid margin of error. For those reasons, Gran Tierra is an attractive, albeit high risk, levered play on higher oil prices which offers considerable potential upside.

This article was written by

Colombian, lawyer, risk manager, consultant, full-time investor. Long only, focused on commodities and infr...

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Recommended for you

Phillips 66 Partners: A Bright Future Ahead - Even Without DAPL

My Oh My, 2 Strong Buys

4 Reasons Baidu Could Make You Rich

Bill and Melinda Gates are getting divorced. Here are some stocks they owned

Comments (25)

That is certainly great news.

How many Venezolanos are still pouring in to Colombia, and is that putting a strain to the local Colombian economy???

Or are they just shipped straight up the "Darién Gap" so that Biden can welcome them with open arms to America???

No comments:

Post a Comment