Aug. 17, 2021

Exxon Mobil No Longer Has A $48 Billion Shortfall

Summary

- Exxon Mobil no longer has a $48 billion shortfall with its cut capital expenditures and rising cash flow.

- The company has been able to pay dividends of more than 6% and it has continued to aggressively pay down the debt it got.

- Going forward, the company has the ability to drive incredibly strong shareholder returns making it a valuable long-term investment at its current valuation.

- I do much more than just articles at The Energy Forum: Members get access to model portfolios, regular updates, a chat room, and more.

Exxon Mobil (NYSE: XOM) recently reported quarterly earnings with an almost $250 billion market capitalization. The company recently reported incredibly strong earnings as it continues to support an almost 6% dividend yield with significant long-term growth potential. With this potential, we recommend investing in Exxon Mobil as a valuable long-term investment, with higher prices reducing the company's chance of its shortfall.

Exxon Mobil Recent Developments

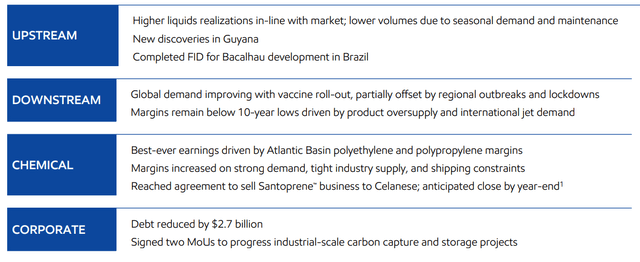

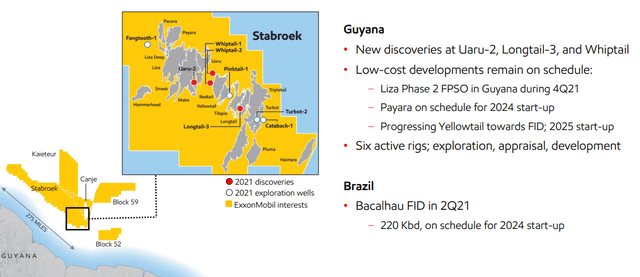

Exxon Mobil has had a number of recent developments highlighting the continued strength of its portfolio.

Exxon Mobil Recent Developments - Exxon Mobil Investor Presentation

Exxon Mobil continued to have new Guyana discoveries in its upstream portfolio, with a completed FID for its Bacalhau development. The company's offshore production has the potential to generate strong long-term production growth. On the downstream sector, the company's global demand is supported by the vaccine rollout which should help with long-term growth.

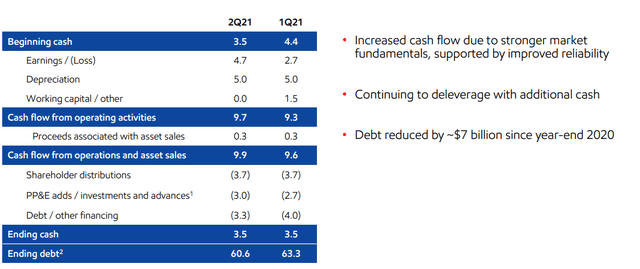

The company has continued to use its cash flow strength to improve its financial position.

Exxon Mobil Disciplined Cash Profile

Exxon Mobil, putting this together, is focused on a strong cash profile to generate strong shareholder rewards.

Exxon Mobil Cash Profile - Exxon Mobil Investor Presentation

Exxon Mobil started 1Q 2021 with $4.4 billion in cash and $9.3 billion in cash flow from operations (with $0.3 billion in asset sales). The company ended the quarter with $3.5 billion in cash after paying off $4 billion in debt. In 2Q 2021, it kept its cash constant after paying off $3.3 billion in debt. The company has paid a dividend of more than 6% while reducing debt by $7 billion since YE.

The company can be expected to continue earning strong cash flow and drive it towards strong shareholder rewards.

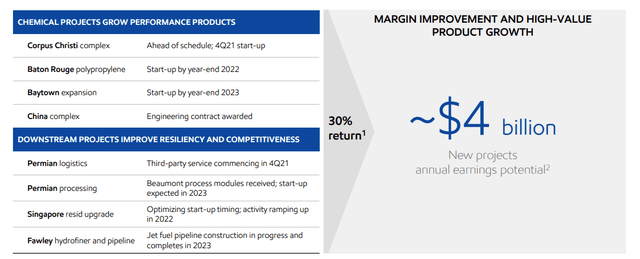

Exxon Mobil Investment Returns

Exxon Mobil projects and capital spending have the ability to generate incredibly strong investment returns.

Exxon Mobil Future Investment - Exxon Mobil Investor Presentation

The company's projects are focused on a 30% return from chemical and downstream projects with ~$4 billion in annual earnings potential from its new projects. These projects are massive for the company, when they alone can give the company a P/E ratio of 60. These projects integrate well into the company's existing assets.

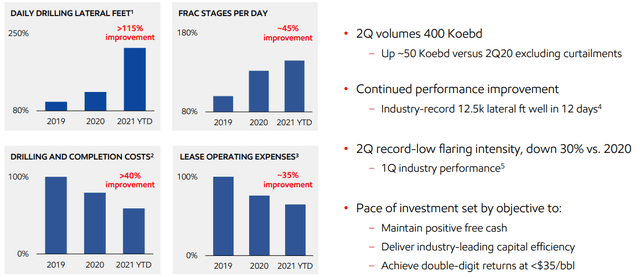

Exxon Mobil Upstream

Delving deeper in, Exxon Mobil has significant longer term growth potential from its upstream asset portfolio.

Exxon Mobil Permian Basin - Exxon Mobil Investor Presentation

The company saw 2Q 2021 volumes of 400 thousand barrels/day. That was a 50 thousand barrel/day YoY increase with the company continuing to reduce expenses and generate massive performance improvements. The company delivers double-digit returns here at <$35/barrel and while it delayed the plans due to the COVID-19 collapse, can ramp up production.

The company much higher potential business for the long-term lies in its offshore development assets though.

Exxon Mobil Deepwater - Exxon Mobil Investor Presentation

The company has made 3 more discoveries in Guyana, an area where its average discovery size has been a massive 500 million barrels. The company has 4 more expected exploration wells which have the potential to discover another 2 billion barrels with expanding to new areas, known oil fields in the company's Stabroek block.

The company's Liza Phase 2 FPSO is expected to start up in Guyana towards the end of the year. The company's Payara is on schedule for a 2024 start-up, pointing towards more than half a million barrels / day of production from the asset. The company's Yellowtail is proceeding towards FID with a 2025 start-up.

The company continues to have 6 active rigs, and we see the potential for a 1 new FPSO a year going well into the 2030s. In Brazil, the company's deepwater assets are several years behind Guyana but still progressing admirably. The company's Bacalhau FID is in 2Q 2021 and the 220 thousand barrels / day FPSO is on schedule for a 2024 start-up.

Exxon Mobil Shareholder Value

Putting all of this together, Exxon Mobil is focused on generating strong shareholder rewards.

Exxon Mobil Shareholder Returns - Exxon Mobil Investor Presentation

Exxon Mobil is focused on generating massive shareholder value. The company plans to reduce expenses and manage capital expenditures while growing its overall balance sheet capacity. The company is focused on improving its base business competitiveness and we expect that, with its overall balance sheet improvements, it'll generate strong shareholder rewards.

One downside here is that Exxon Mobil is in the midst of a maintenance schedule from last year. That difference will cost the company roughly $500 million in earnings for the next quarter. However, it's worth noting the $48 billion shortfall was calculated at prices roughly $30 / barrel below current prices.

Exxon Mobil's production is more than 1 billion barrels/year meaning that the rise in current prices means $10s of billions in additional cash flow. That's massive with the company's current $240 billion market capitalization and it means the company has the ability to drive incredibly strong shareholder rewards.

Exxon Mobil Risk

Exxon Mobil's risk of course is oil prices. At $70/barrel the company has the ability to generate a massive amount of cash flow, however, there's no guarantee that prices will remain at that level forever. That's a risk worth paying close attention to for investors, there's no guarantee that prices will remain at their current level forever.

It's a simple risk but one that affects all oil companies.

Conclusion

Exxon Mobil has an impressive portfolio of assets and the ability to utilize those assets to drive substantial shareholder returns. The company has significant upstream assets that are growing with Guyana having the potential to have 1 FPSO a year in 2024 onwards and Brazil having the potential to start its first FPSO around the same time.

These assets have the potential to generate substantial shareholder rewards, which is something worth paying close attention to. The company, with current oil prices, has the ability to cover its dividend, which is still more than 6%, a substantial capital program, and continuing to pay down debt. All of that strength makes Exxon Mobil a valuable investment.

No comments:

Post a Comment