May 18, 2021

Sell AT&T Stock On Dividend Cut Caused By Discovery Deal

Summary

- AT&T announced a transformative merger on Monday.

- Lost in the headlines, it appears management slipped in a big dividend cut as part of AT&T's new direction.

- AT&T faces a massive debt load and pressing strategic concerns. As such, a dividend cut makes sense as the company shores up its balance sheet.

- Looking for a helping hand in the market? Members of Ian's Insider Corner get exclusive ideas and guidance to navigate any climate.

Over the weekend, news surfaced that AT&T (T) would be looking to join forces with Discovery (DISCA) (DISCB). AT&T confirmed the reports on Monday. AT&T got into the media game in a huge way with its recent Time Warner purchase. Meanwhile, Discovery has remained an independent cable channel and media outfit that has struggled to find a new course in the cord-cutting world.

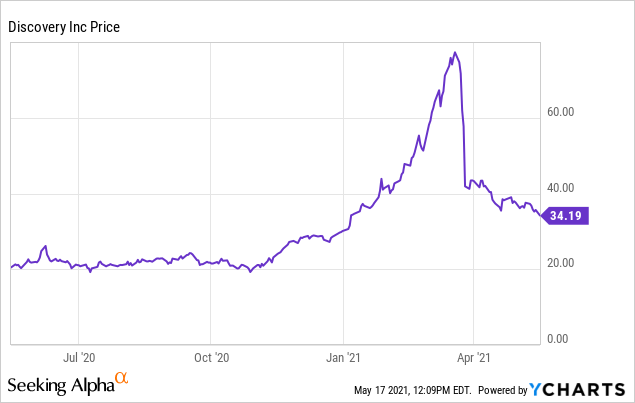

Discovery stock soared earlier this year on an incredible short squeeze. However, once Bill Hwang's Archegos empire collapsed, Discovery stock went with it. As it turns out, Archegos owned a massive position in Discovery's shares. When the banks unloaded that position, they found that there was relatively little underlying demand for Discovery stock at higher prices:

Even with Hwang out of the way since April, DISCA stock has continued to slide. Thus, it made sense from Discovery's end to go looking for a deal. The path ahead isn't getting any easier for legacy media assets. In the streaming environment, bigger is better. B-tier players need to consolidate - and quickly - to stand a chance against Netflix (NFLX) and Disney (DIS).

AT&T must be aware of this calculus as well. And with its own streaming efforts not off to a rousing start, it makes sense for the company to look for more ways to enhance its competitive position. Discovery seems like a good addition to the bunch. It offers a huge swath of content, some of which has a decent fanbase. Alas, the deal won't come for free. In fact, it appears AT&T's dividend will be reduced in order to help fund the company's strategic pivot.

Here Comes The Dividend Cut

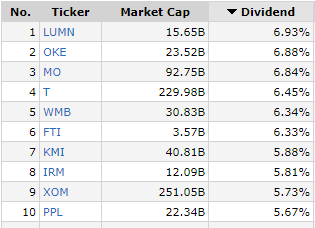

There's long been a great deal of chatter around the state of AT&T's dividend. After all, it is frequently one of the single highest-yielding stocks in the S&P 500.

As of this writing, per Finviz's data, AT&T has the fourth-highest dividend yield in that index, trailing only Lumen (LUMN), ONEOK (OKE), and Altria (MO).

Just 10 S&P 500 stocks currently yield 5% or more. | Source

AT&T has a household name, a seemingly stodgy low-volatility business, and a huge dividend yield. So what wasn't to like?

Unfortunately, under the surface, AT&T's core telephony operations have eroded. The company has thus had to pivot to increasingly risky maneuvers, such as overseas expansion, the DirecTV deal, and most recently its belated push into the streaming market. These moves have encumbered the company with an astounding amount of debt even as the company's earnings and cash flow haven't kept pace.

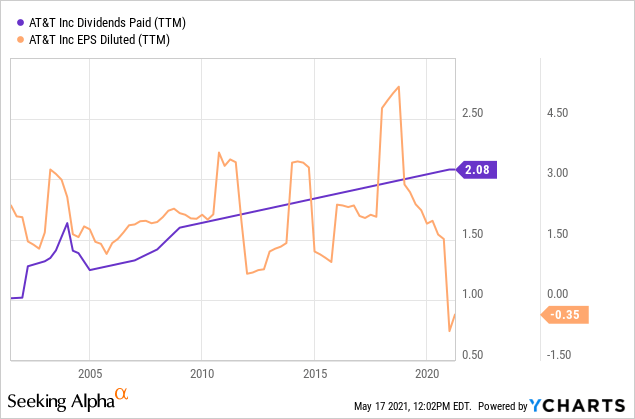

That, combined with AT&T's previous commitment to increasing its dividend payout annually, led to trouble. Over the past 20 years, AT&T simply hasn't been able to consistently grow earnings per share (orange line) yet the dividend was always increased:

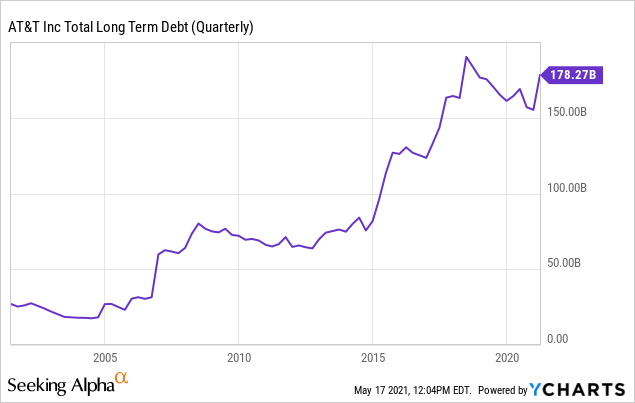

At some point, though, without more earnings, the math just stops working. For a while, AT&T tried to make up the earnings gap by making bigger and bigger acquisitions. As you saw above, this didn't lead to more earnings. It did, however, create a mountain of debt:

Over the past 20 years, even as earnings didn't go anywhere, the debt load soared nearly ten-fold, going from $25 billion to $178 billion.

Governments may be under the theory that they can print infinite amounts of money and borrow unceasingly. Private companies - even blue chips like AT&T - don't have an infinite balance sheet, however. Once the debt load starts hitting these sorts of stratospheric numbers, at some point analysts start wondering if you should really take on even more debt just to pay a bloated dividend.

Stock Will Face Pressure As Income Chasers Sell

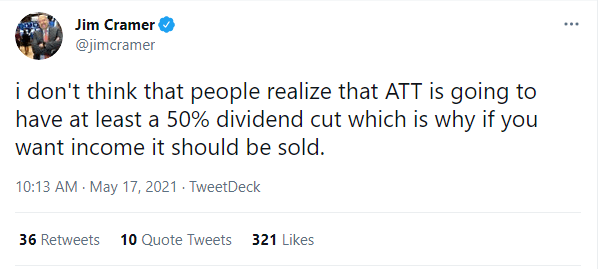

CNBC's Jim Cramer made this point plain and simple on Monday:

"I think the new Discovery is going to be great, but that's not why peopled owned AT&T stock," TheStreet's founder, Jim Cramer, told CNBC's Squawk On The Street program Monday.

"Does this deal give the AT&T shareholder the equivalent of a good dividend, because if you're targeting a payout ratio of between 40 and 43 percent (of anticipated cash flow), well, that's a dividend cut from $15 billion to $8 billion."

As Cramer laid out, AT&T announced that it will only be paying out 40-43% of its cash flow as dividends going forward. Previously, it paid out well over half of its cash flows.

In case that wasn't clear enough, Cramer went to Twitter to make sure everyone understood the situation:

AT&T's move makes sense. Back when it was an oligopoly phone company, it had stable and reliable cash flows. These did face pressure from time to time, either due to competition cutting prices or due to investment cycles such as rolling out 4G or whatnot. Still, AT&T was a cash cow and could run its capital return policy as such.

Now, with the pivot to streaming, however, AT&T no longer has as reliable a financial picture. The streaming wars are absolutely brutal. It will take a long time for that industry to reach a sort of stable profitable equilibrium there that AT&T enjoyed in its legacy telecom business.

Will The Deal Work?

AT&T is known for poor deal-making. Look at its DirecTV purchase, the move into the Mexican cellular market, or its colossal blunder with TCI. The Time Warner deal is too early to judge entirely, but it doesn't appear to be a big winner either.

Unfortunately, AT&T's poor track record in deal-making may be repeating itself here again. For one thing, Discovery may not have proper expectations on what their content represents for consumers. From Monday's investors' call:

"You gotta have content people love so much they would run home and pay for it before they pay for dinner or a roof over their head." - Discovery CEO David Zaslav as cited here.

Discovery, you'll recall, has made its money in recent years with reality TV programs. These are fine enough. They attract a decent audience on a low filming budget. That's good for profitability. But must-see TV these are not. Who is running home to watch Gold Rush or Undercover Billionaire? These are fine enough shows if you want something on in the background, but Zaslav may be seriously overestimating how sticky the audience is.

Combining Discovery with Time Warner will certainly help. If nothing else, it puts pressure on the likes of ViacomCBS (VIAC) and Comcast (CMCSA) to try to do something as the market consolidates. AT&T is signaling that Time Warner is not going to lose the streaming war without a fight. Still, that's cold comfort given AT&T's woeful track record in past deal-making.

AT&T: The Bottom Line

A high dividend yield alone is not a sufficient thesis for owning a stock. Over time, a company needs to have at least a stable business and ideally a growing one to support its unusually generous payout. If it doesn't have core operational strength, the dividend will give way sooner or later.

Decade after decade, AT&T has piled up one terrible deal on another while the core business simply hasn't grown much. It took a long time for all the errors to reach a breaking point, but it appears we're getting there now.

From the company's perspective, the dividend cut makes sense. The company was already the most indebted firm in the world recently. And the most promising engine for growth - streaming - would likely take years to reach maturity if it gets there at all. So something had to be done; more borrowing to prop up a stagnant business wasn't going to cut it anymore.

Unfortunately, for shareholders that owned T stock just for the dividend, that rationale appears to be going away. Post dividend-cut, it appears Verizon (VZ) will yield more than AT&T. Management may still clarify the dividend strategy going forward, but it seems apparent that AT&T had to right-size its payout sooner or later, and this M&A gave the opportunity to do the deed.

In the near term, expect AT&T shares to drop back under $30. Without the support of income investors, the stock will lose a lot of its natural shareholder base. Meanwhile, AT&T will need to market the new Discovery entity to questioning analysts. Already, Discovery shares have dropped sharply during the day Monday as folks digest the deal. T stock may slide along with it.

No comments:

Post a Comment