May 19, 2021

I like to spend 20 minutes to go over the article, and also I like to learn more about AT & T business.

The More It Drops The More I Buy: AT&T

Summary

- Bad news always sells better than good news.

- News about the dividend cut has sent AT&T investors into panic mode.

- The stock is down 8% in the last two trading sessions.

- The deal with Discovery creates immediate big gains for shareholders.

- Shareholders have 20% to 40% total returns over the next year until the deal with Discovery finalizes - using conservative estimates.

- Looking for a portfolio of ideas like this one? Members of High Dividend Opportunities get exclusive access to our model portfolio.

The More It Drops The More I Buy: AT&T

Note that the NewCo will have dramatically higher revenues than streaming peer Netflix (NFLX). In terms of scale, NewCo will be the behemoth of the streaming sector. When it comes to content, NewCo will have something for everyone. Warner has been a top 2 movie studio in 11 of the past 12 years, with tons of scripted TV shows along with premium sports rights. Meanwhile, DISC contributes the most popular "unscripted" content available today.

With more than 200,000 hours in content, this dwarfs their competition on sheer volume. NFLX, for example, has roughly 30,000 hours of content. The real kicker is that NewCo will own the content. NFLX has been facing the reality that as content producers like WarnerMedia start having their own streaming services, they will allow their distribution agreements to expire. This is what has been driving NFLX to invest increasing amounts of capital into developing its own content. Well, Warner has been producing content for more than 100 years, they have more than a little head start.

For content, NewCo will absolutely be competitive and likely blow away the competition. They have the advantage of sheer volume and diversity. 30 years ago, what will be available from NewCo would have been known as every channel on your cable subscription and would cost north of $100/month.

Valuation

One way to value the company is enterprise value/EBITDA (EV/EBITDA). At $14 billion in projected EBITDA for 2023, NewCo would be worth $182 billion at 13 times. Netflix is currently trading at 16 times EV/EBITDA.

To be conservative, we will just use 11 times EV/EBITDA, it would be worth $154 billion. Subtract $58 billion in debt, and that means the equity would be worth $96-$124 billion total. T shareholders will own 71% of that, or $68-$88 billion. That is $9.50-$12.33/current share of T.

And that's just to start. The new service will see significant growth and possibly outgrow Netflix in terms of number of subscribers.

Legacy T

Meanwhile, "Legacy T" (the company excluding WarnerMedia) is still a huge company, one that will be much better focused on their wireless and broadband. Post-split, T will still be producing more than $20 billion in free cash flow. That is $2.80/share.

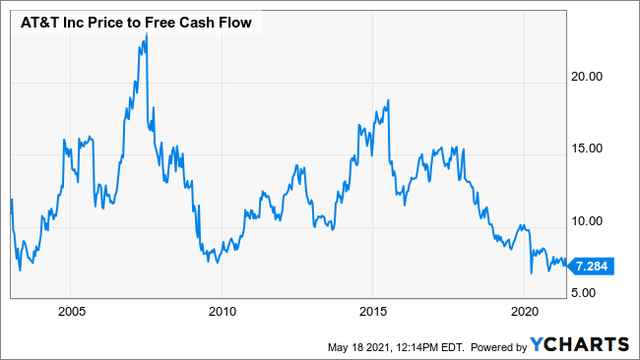

Let's look at T's historical price to FCF: We can see that T's valuation has fallen dramatically to lows not seen since the Great Financial Crisis. Ironically, many have blamed this decline on T's acquisition of Time Warner. If that was indeed the culprit, then we should see T's valuation rebound back to 15 times!

We can see that T's valuation has fallen dramatically to lows not seen since the Great Financial Crisis. Ironically, many have blamed this decline on T's acquisition of Time Warner. If that was indeed the culprit, then we should see T's valuation rebound back to 15 times!

Before T's acquisition of Time Warner, it routinely traded above 10x FCF outside of recessions. So how much is T worth post spin off? Well on the low-end, let's assume the value remains as low as it is today at 7 times. And on the high-end, let's assume 10 times - still a very conservative amount. That implies a valuation of $19.60-$28.00.

Sum Of The Parts

So for T shareholders:

- They will be getting shares in NewCo that are worth $9.50-$12.33. Arguably, NewCo could be worth much more, but we would want to err on the conservative side.

- Second, the legacy business would be worth $19.60-$28.00/share, assuming that it continues to trade at valuations consistent with those it had during the GFC and COVID. Call us crazy, but we don't consider GFC or COVID to be good comparable times for valuations.

That means that even with incredibly bearish valuations, T is worth $29.10 today at the minimum. Assuming still very conservative valuations, it is worth $40.33.

For The Shareholder

With the market panic about the prospects of a dividend cut over the past two days, investors have a great opportunity to buy the stock at very attractive valuations. Today, T is trading back close to $30/share.

Additionally, investors will have at least one more year of "big income" as T intends on paying out the full $2.08 dividend currently yielding 7%. The dividend will not be changed until after the spin-off.

A buyer today investing $30 will gain:

- $2.08 in dividends per year until the deal is closed.

- Two stocks (AT&T and the NewCo) with a combined worth $35-$40+ when the spin-off occurs in about a year.

That's a total return of 20%-40% in the span of about one year.

It's also entirely possible that the NewCo will be trading at such a high valuation that the AT&T investor who sells his share in the NewCo (when it starts trading or a few months later) and re-invests back the funds in AT&T may not lose a single penny of income.

We are not the only ones excited about this deal. According to Bank of America,

AT&T's stock could jump roughly 50% from current levels as its newly-formed media conglomerate with Discovery unlocks value.

Conclusion

The market can be an emotional place. Many investors will read one data point and panic. For this merger, many investors were either fixated upon the dividend and/or read some analysis that only showed one side of the coin, creating undue panic. Unfortunately, one-sided analysis can be hurtful for investors, and often results in unnecessary losses.

At High Dividend Opportunities, we're long AT&T and we took a decision from the start not to sell. I personally added to my position yesterday morning at open when the market was in full panic. I will be happy to buy more if the price drops further. Based on our conservative analysis, there are 20% to 40% returns over the next year by investing in AT&T today, holding on, or adding to your position.

No comments:

Post a Comment